When I was in college, I used to make lot of hypothetical plans in my mind that I am gonna do this and that after I get my first First Salary. But the underlying reality is, When you get your first salary and you cannot do everything you have planned with it because it is the lowest pay cheque of your life.

When I received my first salary, I used to login and see the balance in my account for no reason and I used to feel so happy just by seeing it. I don’t have exact idea but i must have done it at least 20 times at first. What did you do? Please comment below 👇

I am writing this with my 8 years experience of wasting, investing and learning money. I have seen youngsters wasting their money on the wrong things. With their money, they either make rich to bigger clothing brands by purchasing branded clothings, phones, bike… or spend money on so called fun things like drinking, smoking etc.

I do a lot of talking on investing money and financial planning with my colleagues and friends and sometimes they criticise me for this. Then I kinda remind myself what Aristotle said long back :

There is only one way to avoid criticism: do nothing, say nothing and be nothing.

So I have made a list of 5 things to do after you receive your first salary. Here they are

Get a Term Insurance

You will meet many new people around you and these faces will change around you. One things will always be the same i.e. Your family. Most of the people who start earning they become sole bread winner to their family after parents gets retire.

No body has foreseen the future and causality might happens. But just imagine, What will happens to your near and dear one when you are no more. Nothing can complete that void but Yes, Insurance amount can support your family in your absence. So do think about this once.

Terms Insurances are cheaper once you get it at early age. It is comparatively offers high risk cover in less amount compare to other. endowment plans.

![]()

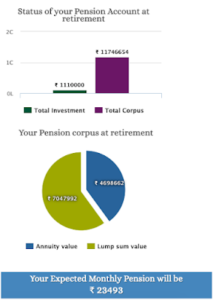

Note: I am not promoting this plan rather I am simply giving an idea that you can have an insurance cover of Rs 1 Crore by merely spending Rs 552 per month.

Get a Medical Insurance

So It becomes very very important for you to have a Health Insurance. You may feel like these things are unnecessary burden to you but believe me its worth taking one and It’s an essential part of Financial Planning.

Start Building an Emergency fund

Start Planning Your Retirement

0 Comments